An aerial view of Anable basin, where Amazon had planned on building its new headquarters. (Kevin P. Coughlin/Office of Governor Andrew M. Cuomo)

Feb. 14, 2020 By Christian Murray

The Long Island City condo market has remained strong despite Amazon’s decision last year to scuttle its plans to build HQ2 around Anable Basin.

Condo prices have not dropped over the past 12 months as was initially feared, although the number of units going into contract has slowed significantly since Amazon abruptly shelved its plans on Feb. 14, 2019 to come to Long Island City.

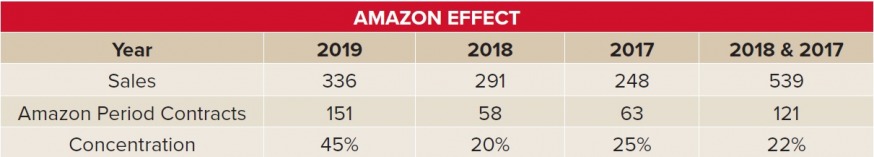

Nearly half of the condo units—45 percent–that closed in 2019 went into contract during the 101-day period between Nov. 5, 2018 and Feb. 14, 2019 when Amazon was anticipated to bring HQ2 to the neighborhood, according to a report compiled and published by Patrick W. Smith, a new development specialist with The Corcoran Group.

In 2019, 151 of the 336 condo deals that closed were signed during the Amazon period, according to Smith’s report. Many deals, however, signed during that time frame have still yet to close since they involve new developments still being built.

The Smith Report | Patrick W. Smith

“We experienced an unprecedented increase in real estate activity during this time,” Smith said, referring to the 101-day period. “I don’t think there has been anything like this in the New York—where a piece of news was announced that caused hundreds of investors and homebuyers to want to buy. It was as though someone hit a light switch.”

Eric Benaim, CEO of Modern Spaces, said he was receiving texts from people wanting to sign contracts after Amazon selected Long Island City for HQ2.

“After the announcement, Modern Spaces sold 300-plus units at new developments like Skyline Tower and Corte within three weeks,” Benaim said. The firm typically sells around 40 units per month.

The loss of Amazon came around the same time that seven large developments were all starting to hit the market—accounting for 1,252 units, according to Smith’s report. Many units went into contract during the Nov. 5, 2018 to Feb. 14, 2019 period—although most are still yet to be sold.

A little more than one-quarter of the units in these seven developments—or 342 units—had sold by Feb. 13, 2020. The majority of the units that still remain unsold are in the massive 67-story Skyline Tower, an 802-unit building that won’t be fully completed until 2022.

Smith said that the condo market has a lot of units to digest and it will take time to sell them all. However, he said they will be absorbed since the market remains strong and there is time since the buildings have yet to open.

“The fundamentals of Long Island City have not changed,” Smith said. “The neighborhood remains an affordable, dynamic area. It has the great waterfront parks, schools that are being built…and we are one stop from the largest office district in the country.”

In fact, the market has fared well post Amazon—both in terms of demand and price.

Benaim said that Modern Spaces saw more units go into contract between Feb. 15, 2019 and Feb. 13, 2020—than the for the 2017 and 2018 years combined. He said that after Amazon announced it was no longer coming to Long Island City, he had people—particularly residents– reach out because they thought they could get a deal or that it would become more affordable.

But the discounts have been sparse, with prices remaining firm post Amazon, according to Smith’s report.

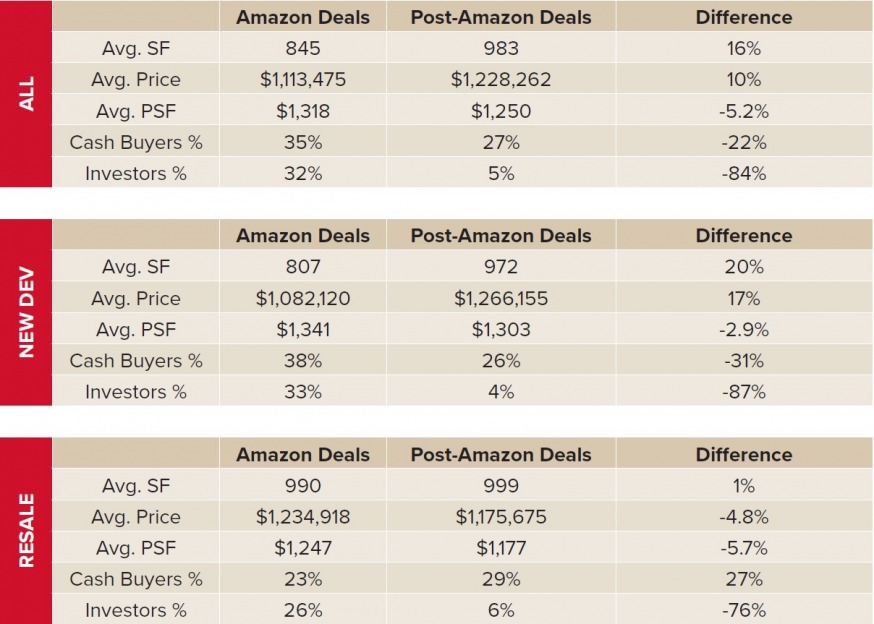

During the 101-day Amazon period, the average price paid for a condo that went into contract –and closed in 2019– was $1.1 million, at $1,318 price per square foot, according to Smith’s report.

The Smith Report | Patrick W. Smith

On deals that went into contract after Feb. 14, 2019 and closed last year the average price paid was $1.2 million, with at an average price per square of $1,250. There were 117 deals that closed in 2019 that were signed after Amazon announced it was no longer coming to the area.

Benaim said the market’s resilience is no fluke. “Amazon selected Long Island City for a reason and the only reason it didn’t come was due to the political climate—but everything else remains.”

The strong market in 2019 represented a continuation of what has been a remarkable decade for Long Island City real estate—with the price per square foot doubling over the 10-year period.

The median price paid for a condo in 2019 was $993,000, representing a price per square foot of $1,304, according to Smith’s report.

In 2010, the median price paid was $628,000, at $645 per square foot.

During that 10-year period, 2,536 condo units sold in Long Island City representing $2.33 billion in sales.

Smith said that Amazon’s interest in Long Island City has helped the area—despite the disappointment in its departure.

“There was a significant public relations value in the announcement… and Amazon helped accelerate the absorption of the units that would have taken a longer time to sell.”

7 Comments

Don’t understand why all the community wanted Amazon to move in. Unless you’re getting a coding job with them you’re getting shafted when your rent skyrockets.

Where are the developers going to get their prospective buyers /suckers now? China has pretty much been shut down.

As it turns out, the “LIC Amazon Debacle” “was all good”.

In a “Nutty Shell”, “Could have been better but what the heck”.

If your idea of “resilient” is Chinese nationals parking their money in empty LIC apartments to avoid seizure of their funds by red China, then, yes, it is “resilient.” By any other normal measure it is insanity not resilience.

Too bad our local colleges are in bad shape.

Amazon had been in talks to help them.

Thanks a bunch, AOC!

Don’t believe the hype. Developers are are paying all transaction fees so they don’t have to lower the asking price.

Not uncommon for sponsors to pay xfer tax on new dev projects. They were doing this as far back as 2010 in the neighborhood. #notabroker