State Senator Jessica Ramos and Council Member Costa Constantinides (NY State Senate and Facebook)

May 14, 2020 By Michael Dorgan

Two Queens lawmakers argue that the World’s borough is being short-changed by City Hall when it comes to small business aid.

State Senator Jessica Ramos and Council Member Costa Constantinides have called on the city to create a new strategy to help small businesses in the outer boroughs recover from the COVID-19 economic shutdown.

The lawmakers, citing city data, are upset that small businesses in Manhattan have snagged more than half of the $19 million in COVID-19 relief funds provided by the city for small businesses across the five boroughs.

The pair penned a letter on May 11 to Mayor de Blasio and members of his economic team arguing that more needs to be done to help small businesses outside Manhattan.

“The fact that a vast majority of the city’s financial relief went to Manhattan businesses demonstrates that smaller, neighborhood-based, immigrant or minority-owned businesses in the ‘outer-boroughs,’ a term we loathe to use, likely did not know that these programs existed or didn’t understand how to apply,” they wrote.

The city launched two small business relief programs in March following the COVID-19 shutdown, which were run by the Department of Small Businesses Services. The programs closed about three weeks later with $19 million disseminated to around 2,600 firms.

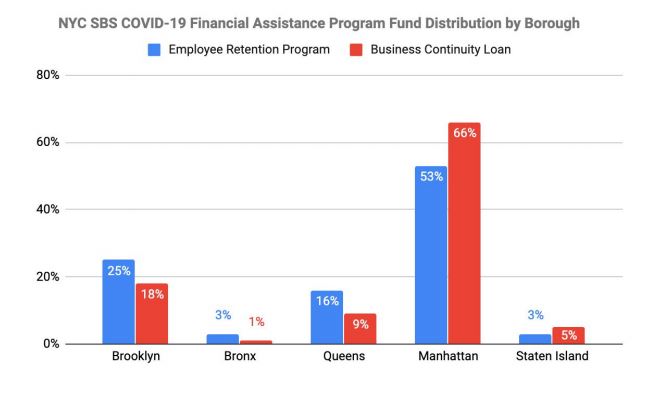

More than half, 53 percent, of the Employee Retention Grant went to small businesses in Manhattan whereas firms in Queens only received 16 percent of these funds. This program– geared for firms with fewer than 5 employees– covered 40 percent of the payroll costs for two months for small companies that kept their workers.

Similarly, 66 percent of the Business Continuity Loan Fund went to small businesses in Manhattan and only 9 percent went to those in Queens – a seven-fold difference. This program provided zero-interest loans of up to $75,000 to help ensure businesses with less than 100 employees survive.

The two lawmakers said that the distribution of funds revealed a number of disparities among city residents and illustrated yet again how these programs don’t serve immigrants– particularly those that are not tapped into government policy.

“This is a problem we see time and again. It’s usually the folks who are not foreign-born, have better education access, and are wealthier from the start who best understand how to access government resources,” the pair wrote.

The lawmakers want a new system put in place to help the city assess the needs of outer outer-borough businesses and their respective neighborhoods. For example, the city should ascertain what languages are spoken in these areas and create a more effective way of reaching out to these businesses, they wrote.

“Most businesses in our districts tell us that the only time the government comes around is to conduct an inspection or issue a summons. This is a norm that must change,” they said.

Ramos and Constantinides said that while the agency had been responsive and helpful to their constituents, the city as a whole can do better.

“Crisis moments give us an opportunity to see the cracks in a system and where we need to improve. We believe that’s the case here.”

Small Businesses Services COVID-19 Fund