Citylights residents rallying at Gantry Plaza State Park on Jan. 3 for tax relief. (via Comptroller Stringer)

Jan. 4, 2019 By Christian Murray

To some, buying a Citylights co-op in 1997 could be viewed like winning the lottery.

Units in the 42-story building fetched as little as $10,000 in 1997 when the building first opened.

Today, those same units sell for about $600,000–or can be rented for $3,000 to $4,000 per month.

But residents in the 522-unit coop at 4-78 48th Ave. are not rejoicing. Instead they are out protesting a property tax hike, as the building’s 20-year tax abatement has finally run its course. Their maintenance bills are being increased by 9 percent each year for the next five years to cover the large tab.

The tax hike, which went into effect in July, means that unit owners will see about a 50 percent jump in their monthly maintenance fees over 5 years. One unit owner said her maintenance is projected to go from $2,600 a month to $3,900 per month in 2022.

The co-op owners at the Hunters Point building have been holding rallies for the past several months—joined by local officials such as State Sen. Mike Gianaris and Council Member Jimmy Van Bramer—fighting back against the hikes and arguing that the changes will force many of them to leave.

On Thursday, Citylights residents rallied once more at Gantry Plaza State Park, and were this time joined by City Comptroller Scott Stringer, who called for the city and state to grant these co-op owners relief.

The protest came in light of the recent deal to bring Amazon to Long Island City, with Stringer arguing that if the city and state could provide the tech giant with $3 billion in subsidies to build out its campus, that they should help Citylights co-op owners, too.

“It’s time that we show the people who built this city that we value them just as much as a multinational corporation and give them the relief they deserve,” Stringer said.

The rally came one day after Stringer wrote to Mayor Bill de Blasio urging him to work with the state and the co-op board and come up with a solution.

“Particularly in the context of the literally billions of dollars in inducements the City and State are providing to bring Amazon to Long Island City, the cost of extending tax relief to these Long Island City homeowners would be trivial,” he wrote.

Citylights from Gantry Plaza State Park (Photo: WiredNY)

The tax hike for Citylights residents stems from two factors—an expiring state tax abatement, and a city assessment of the building that doubled its value in recent years.

The building’s 20-year tax abatement provided by the state—similar to a 421 a tax-exemption program that many condos benefit from– is being phased out over the course of the next five years.

Under the abatement, the co-op built on state-owned land didn’t have to pay property tax until July 2018, when the phaseout began.

But the tax is now being phased in at 20 percent per year until 100 percent of the assessed taxes are payable starting July 1, 2023.

For fiscal year 2019, the building is subject to $800,000 in property taxes, which will go up to $5.8 million over five years.

The total maintenance costs of the building, as a result, are projected to go from $10 million to $16 million in fiscal year 2023 with the hike.

The tax, meanwhile, is based on the building’s assessed value that went from $51.7 million in 2016 to $101 million in 2018 after a review from the city Department of Finance.

The co-op board claims that the valuation is inflated and is appealing the agency’s decision.

The original co-op purchasers also argue that the building was pitched by the state as “affordable” in its bid to lure middle income people to the area, and that they took a chance on Hunters Point as “pioneers” when the neighborhood was desolate.

Indeed, studios could be bought for as low as $10,000 at the time, with three-bedroom units fetching around $65,000.

But the trade off in offering units at low prices was that the owners would collectively be responsible for an $86 million mortgage that covered a large chunk of the development costs. That mortgage kept purchase prices low, but inflated maintenance payments in order to service the debt.

The co-op owners still owe about $86 million. Today, the building pays $4.5 million each year to service the loan.

Residents say they don’t have the means to cover the loan, the taxes and other maintenance costs.

Despite the rallies and the co-op building’s financials, people continue to buy units and pay big prices.

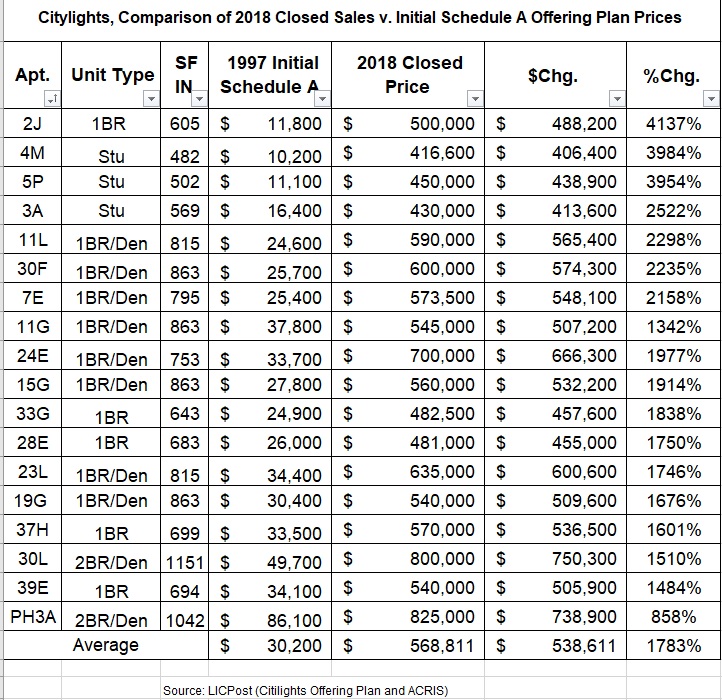

For instance, a one-bedroom unit with a den sold for $600,000 in 2018, a significant jump from the unit’s original offering price of $25,700 in 1997.

Meanwhile a 2-bedroom unit that was originally offered in 1997 for $49,700 sold for $800,000 last year—a profit of $750,000.

Citylights offers panoramic views over the East River and Gantry Plaza State Park (11th Floor view)

In 2018, the average price paid for a co-op in Citylights was $569,000, according to a Citylights market report released by Patrick W. Smith of Stribling & Associates this week.

The majority of the early coop owners, meanwhile, have sold their units since the building opened, with about 300 sales transactions taking place in the last decade.

Some have made large profits over the years. For instance, Eric Gioia, the city council member prior to Jimmy Van Bramer, bought a unit in Citylights in 2004 for $195,000 and sold it for $372,000 in 2007.

About 40 percent of the current owners are the same people who bought units back in the late 1990s, Shelley Cohen, the building’s treasurer said in July 2018.

Some apartments listed by unit holders on StreetEasy also provide insight into pricing. One bedrooms are listed at $2,900 and 2 bedrooms at $4,500.

However, residents continue to cry foul.

“The City and the State are extending handouts to big companies, like Amazon, while my middle-class neighbors and I suffer,” Cohen said in a statement after the rally.

The state said over the summer that it is willing to negotiate the terms of an abatement and possibly extend it to 35 years, as some residents prefer, but that it needs the city to step in, too.

The city, however, said at the time that it is aware of the issue, and that the tax commission is reviewing the building’s appeal for the property’s tax assessment.

Stringer said Citylights residents took a chance in coming to the area and are the backbone of the neighborhood.

“Yes, change comes and skylines change, but the people who build our communities—our pioneers—they must stay,” he said. “They must be celebrated.”

33 Comments

This building has suffered from serious mismanagement by previous boards and is not paying the price. They took out a new mortgage about 3 years ago and paid a $20 million pre-payment penalty. The residents were furious but the board did it any way. They never increased maintenance over those 20 years because the board president knew this would continue to get him re-elected – and it did. He ruled the board for years and convinced people he was doing a good job when he in fact was leading them into this disaster. They never built a reserve for the taxes. It was always believed the taxes would be about $3 million and now they are $5.8 million. That $2.8 million should not be putting this building over the edge. They are really asking the city and state to bail them out of this mismanagement.

these people knew what they were getting into, no sympathy. they should drop a nice hefty flip tax on units sold since theyre all property wealthy. The flip tax money going straight to paying off the debt

this is like feeling bad for thurston howell III and his wife lovey!

These typical liberal democratic socialists… everyone should pay their taxes except for me me me!

Wait…citylights residents advocate political democracy alongside social ownership of the means of production?!

Or do you just have no idea what democratic socialists are, and just blindly parrot the whatever Fox News tells you is the boogeyman-of-the-week? ?

Lots of trashing of the seniors who used their 1999 savings to invest all cash—demanded—by the new co-op—into their retirement home. I live here, in my seventies—no income balloon coming my way, and I will be homeless if this contiunues. Unsaid: Our land in RENTED. Citylights pays $700,000. per year to Queens West Development Corporation, an entity formed by the Port Authority to revive the East River waterfront. Why do we, alone, continue to be double-taxed?

The cruel comments below speak to the pressures we are all under as the heel of the truely wealthy and real estate speculators crush us all. Instead of jealous, mean trolls, how about standing together?

Agree, there should be a facility to help our seniors on a limited income.

The larger issue is that the building is market rate. Shareholders of City Lights can sell for whatever price the market bears, no cap on profits and about a quarter of the building is held by real estate investors.

To boot, purchase prices are about 40 percent less than a condo to make up for the higher monthlies.

With amazon, contract activity is picking up and several sellers at City Lights have increased their asking prices.

While it is every property owner’s right to grieve their taxes, to say CL is an affordable housing complex is untrue. We have no income limits, no cap on resale profit and we can rent our apartments after a year.

If the government needs to intervene to help lower carrying costs, we should be subject to regulation, cap our profits and make the building available only to those indivuals with low incomes.

Thoughts?

Standing together when it benefits who? It was expected that when this investment was made that the tax abatement would expire… if your tax abatement is extended why shouldn’t every coop or condo in the city be extended. Please tell me why you are so special? we all have money issues but this isn’t something you were blindsided with. There is always the option of selling the property and going to a state where the profits will set you up better if the city is too expensive. As a home owner my tax bill keeps going up… is someone going to help me out because Amazon is moving in? One has nothing to do with the other.

Hey D how about a reverse mortgage type deal???? You monthly stays fixed and when you die or sell and move to FL, all the accrued IOU”s get paid first.

For example if your maintenance goers up $1500 a month that’s $18K a year times 20 years or $360K will be deducted off the selling price and your kids grand kids will have the rest.

Who in their right mind would pay $600K for an apartment with a tax abatement ending? and who was the retarded bank who gave them the loan? These apartments should have never gone above $200K tops with this down the road.

Even if that person put 10% down in 1997, they likely have paid a significant chunk in mortgage since then, so not $10K returned $750K, and they have been paying STEEP maintenance costs that entire time (maintenance in recent years has been over $2K per month for a 2BD, meaning just two years is almost the purchase price of the unit), so you have to factor all that into what the actual return is. If you paid $10K out of pocket in 1997, then made mortgage payments and paid high maintenance for 20 years, it’s more like $300K-$400K (plus any costs of improvements and repairs out of pocket over the years) nets the $800K purchase price. Still pretty good return, but certainly not $10K=$750K.

I already considered the mortgage and maintenance but to me, you can’t count that because that money would have been paid for rent anyway.

As for maintenance projects, it sounds like the building took out more principal when they refi’d the mortgage. Otherwise the mortgage would have been paid down by now. The fact that the principal hasn’t been paid down a dime implies principal was taken out, presumably to keep maintenance costs artificially low.

So they paid an insignificant amount of money for a 2BR apartment, maybe even with a tax deductible mortgage, and now have to pay $2000 a month in maintenance costs.

Do you realize that adding maintenance into the calculation is ridiculous? Even if they did not live at city lights,, wouldn’t they have to pay to live somewhere else? Or do you think they would have just lived in their parent’s basement for free?

I’m sure there would be huge waiting lists for 2BR apartments in luxury buildings for $2000 a month.

They had 20 years to live off of the taxpayer’s generosity, time to start paying their fair share.

What exactly did these buyers think a 20 year tax abatement meant? Time to pay your fair share folks.

Interesting that 40% of the dwellers are the original owners. They knew this day was coming. Did they think something would change in 20 years and they’d be free of this agreement? We must assume that the 2nd or 3rd owners knew what they were getting into as well. Sorry, but that’s the reality. I’ve been a home owner in nearby Sunnyside for 14 years and my taxes have gone from about $1,800 a year to over $7,600 a year in that amount of time. I often feel that I’m helping to pay for all the goodies and improvements that are happening around the Gantry area and City Lights. I’m certainly not getting all the “stuff” they are. No sour grapes, though. If you want something, get out there and fight for it, which the “protesters” are doing. Probably won’t do any good, much like the bike lane protests.

The Real Estate Board of New York (REBNY) is an entity funneling money to reelect and influence our elected, including Albany. Overheated real estate sales personnel want high turnover and inspire degrading all owners, real property or co-op shareholders, alike. Citylights experienced a double whammy, a criminal escalation of taxes AS IF there was ownership of land. The building RENTS the land from Queenswest corporation, 700,000. for land rent.

We are all being soaked, and should and could fight for tax equity against giveaways such as Amazon will experience. $850,000 for the NYC department of education building on Vernon Blvd., refunded in the fine print, for a ten story, giant building housing supply and training facilities for 1,250,000. students.

That bullion it was worth, and expenses to equipe, move and make facilities for DOE needs comes out of taxpayers, especially property owners facing predatory taxation. We are in this fight together. Get over jealousy.

I could see a case for arguing the City’s assessment, since we know the City is desperate for cash and trying to squeeze property owners anywhere it can to finance the Mayor’s pet programs. But the 421 should not be put back in place. The program is designed to encourage owners to buy in “riskier” buildings and is more than balanced by the appreciation of the units. It isn’t like they didn’t know this was coming.

Ask our socialist mayor why is his house worth 2 million and he pays 3800 a yr. Me and my husband pay three times as much on a class 1 home.

To those in power go the spoils. You think it’s bad now. Wait till the radical progressive wing of the Democratic Party win the Senate and the Presidency in the next election. You wont have to worry about those taxes on your house because your house will be taken from you when they redistribute the wealth. Ocasio is already talking 70% tax for income over over $10 million. When those folks move their money out of the US that amount will drop to $60 grand fast. The Democrats control all three branches in NYS. Its only a matter of time before more taxes to pay for more entitlements. I suggest you sell your house before the hikes like I did and move to a more tax friendly state. Otherwise just join the singalong “I luv to be in America, Everything free in America” Weeeeeeeeeeeee!!!

Why would rich people move their money out of the US? The proposed tax is just for INCOME over $10 million in a year. It’s not a tax on wealth. Someone making $11 million will not be paying 70% on all $11 million. It used to be over 90%, even under Republican presidents.

I would not be effected by it with my meager salary, but I dont believe ANY politician (Republican or Democrat) will ever stop increasing taxes despite having reached a 70% threshold after $10 million. Why should they when they can buy votes with that money. Lots of people thought the same way about the alternative minimum tax when introduced but have a different opinion now. Take a look at Google who move millions to Bermuda to avoid taxes. Search the internet for all the rich people with offshore interests. As Kamala said, somehow Comrade Bill doesnt seem to like paying taxes but its okay to keep increasing taxes on everyone else. I’m concerned that when politicians run out of, or cant get their hands on, other peoples’ money, they will come for my crumbs. No worries though, why should Jeff Bezos move his money out of the US when Amazon will be paying a mere pittance for those nice new buildings in LIC

Increase taxes AND reduce corruption. Taxes need to go up to improve infrastructure. Introduce term limits and ranked choice voting. Greedy companies and people will always exploit loopholes to pay less, the right thing to do is close loopholes. And stop giving taxpayer money to corporations.

In the 1950s the US had a 91 percent top marginal tax rate.

CEOs made far less, the gap between rich and poor narrowed, and the economy boomed.

Look beyond Wikipedia. Nobody actually paid at the 90% rate – there were all sorts of loopholes and it was easy to cheat. But this thread isn’t about the proposed 70% tax rate.

Yes, I’m also wondering how the original mortgage was $86mil and they still owe $86mil today. Does anyone know the answer to this?

Looks like they chose not to pay the principal and only pay the minimum required payment (interest). This way they could pay the lowest possible maintenance. I wonder what their maintenance was over the years. Now that the mortgage was never paid down plus the taxes this building is under water. Looks like selling is the best option, unless state provides further abatement, in which case it will be double win for the residents as the value of the units will go up if they decide to sell or if they remain they will pay lower maintenance.

Someone took the initial D” for a comment, who is not “D” responding to “Wat” above.

1. Tax “abatements” allow rich entities to further enrich themselves with sops of “middle” and/or ” low” income housing support. Taxes are pressed onto current middle income housing, single and co-op. Winners: Developers, such as Trump-style predators. REBNY, the realty payoff machine for Cuomo and our presidential mayor.

2, How many realtors on nearby Vernon Blvd., ? Each office has two or more sales people posting here. Mostly renting newbies, and ignorant except for pontifications about Renzo Piano designed landmark, uncaring of this neighborhood. And Snark.

First, there were no three bedroom units offered in the building. Any three bedroom was originally a two that’s been converted. Second, while the tax assessment is inflated many of these residents can pay but are lumping themselves together with the smaller minority in the building that can’t to avoid the tax. Citilights has many wealthy residents with combined apartments and multiple luxury cars in the lot, they don’t need a tax break extension. The city needs to find a fair way to deal with the issue on a case by case basis taking into account income, age, employee status, etc. Why would someone in a penthouse with multiple luxury cars get the same tax breaks as a retired couple sharing a studio since the 90s, that doesn’t seem fair, especially when those lost tax dollars have to be passed on to everyone else in the neighborhood.

Time to pay the piper. Should have sold while the going was good. If CityLights gets a pass on taxes then all homeowners should. That’s the price for Manhattan views on the cheap for the last 20 years. Pony up folks. The majority of CityLight residents most likely voted for Comrade Deblasio so dont complain when he needs the money for public urinals and needle disposal cans in Gantry Park

They knew this was coming. Time to pay up…

#Sorry

This is an easy fix, have the city of New York purchase and convert a portion or 1/2 of the building into a NYCHA housing in exchange for a reduction in the property taxes and maintenance for the remaining owners, have NYCHA take over the building maintenance, sweeping, garbage and repairs to reduce costs with an extra incentive and reduction in taxes if 1/4 of the new tenants they take in are drug addicted/mentally infirm tenants in recovery, the remaining tenants displaced homeless families currently living in area shelters. These new neighbors will improve the area, bring crime down, improve property values and can they can congregate at the new multi-million dollar Hunters Point library, Gantry and Hunter Point Park during the day and evenings improving the quality of life of all in the neighborhood.

Excellent proposal

This will be an interesting Roarsarch test. One point not covered is how the $85mm mortgage is still $85mm 20 years later. That should be over half paid off by now. Have they just been refinancing and kicking the can down the road?

And while it is true that the person who bought for $50k and selling for $800k received a $750k cash profit, consider also that this person may have only out 10-20% down on the original $50k. So $10k returned $750k.

Seems like poor management

Low initial mortgages to offset the loan that would have to be paid down…

And it hasn’t even been touched

Now they can’t afford the increase..should’ve planned better for the last 20 years.