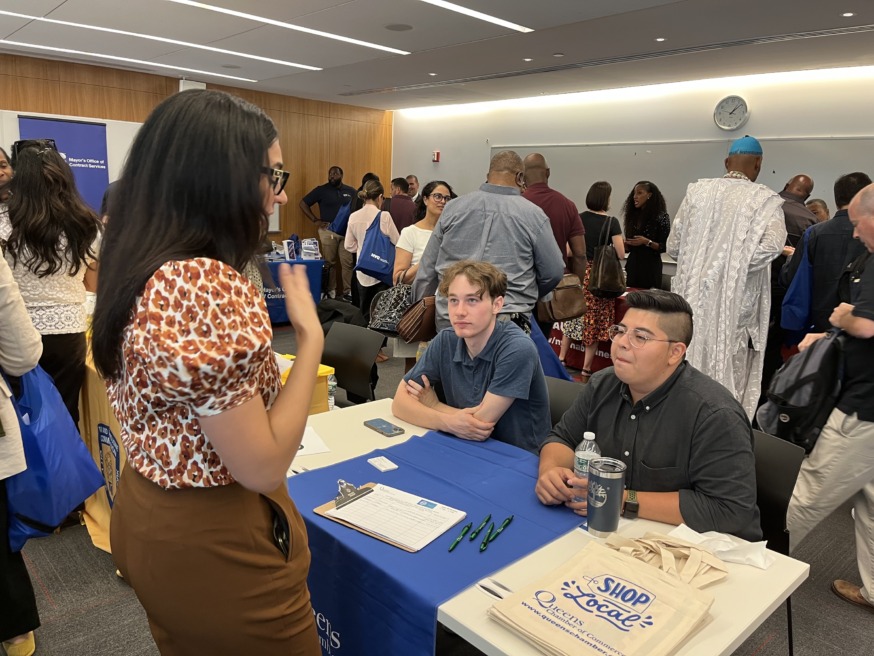

More than 200 M/WBEs in Queens were represented at the city’s first MOCS in Your Neighborhood networking event at CUNY School of Law in Long Island City. (Photo courtesy of MOCS)

Aug. 21, 2023 By Bill Parry

Two city agencies are increasing their efforts to connect minority and women-owned business enterprises (M/WBE) to the resources they need to succeed.

The Mayor’s Office of Contract Services (MOCS) is hosting monthly workshops across the five boroughs like its very first M/WBEQueens Networking event on Aug. 9 at CUNY School of Law in Long Island City. In September, they will host their next MOCS in Your Neighborhood event in Brooklyn.

“The MOCS in Your Neighborhood initiative is one of the ways New York City is investing in small and minority-owned businesses and the communities they serve,” MOCS Director Lisa Flores said. “Business owners are busy. Closing up shop to travel across the city for information is inconvenient and costly. We need to show up better for these businesses by providing opportunities that work for them and not against them.”

Participants were able to consult with 18 city agencies and the Long Island City Partnership and the Queens Chamber of Commerce. (Photo courtesy of MOCS)

More than 200 small and minority-owned businesses were represented at the Long Island City event where they consulted with 18 city agencies on how to contract with the city, help with M/WBE certification and share NYC procurement needs. The Long Island City Partnership and the Queens Chamber of Commerce also attended.

“The MOCS in Your Neighborhood monthly workshop series invests in communities across the five boroughs by preparing businesses to actively compete and win city contracts. This month’s event was especially exciting because we are adding business networking into the day’s agenda. This will allow businesses to showcase their services to contracting agencies and learn more about the types of goods and services New York City procures.”

Councilwoman Julie Won welcomed MOCS and the participants to Western Queens during her opening remarks.

MOCS Director Lisa Flores (l.) joins Councilwoman Julie Won at the first Queens Networking event. (Photo courtesy of MOCS)

“Our small and minority women-owned businesses are the heart of our district. They provide food, products, and services that keep our neighborhoods going,” Won said. “Events like ‘MOCS in Your Neighborhood’ help businesses learn how they become certified as M/WBEs, access critical services, and get guidance on how to apply for city contracts. Thank you to the Mayor’s Office of Contract Services for coming to Long Island City to ensure that our small businesses have access to these opportunities to do business with our city.”

On Aug. 17, NYC Department of Small Business Services Commissioner Kevin Kim announced a major expansion of the Contract Financing Loan Fund that will enable the city to provide an additional $50 million in low-interest funding to M/WBEs. The announcement comes during the city’s “Black Business Month,” featuring outreach and events led by SBS’s Black Entrepreneurs NYC initiative to spotlight and serve Black-owned businesses.

“SBS is committed to helping Black businesses grow and thrive across New York City,” Kim said. “Through our work with partners in government and in the community, and through this historic expansion of the CFLF, we are deploying every resource at our disposal to meet that goal. Thanks to Mayor Adams and Deputy Mayor Maria Torres-Springer, New York City is putting our dollars to work for hundreds of diverse businesses as they fulfill millions of dollars in City contracts.”

The Contract Financing Loan Fund (CFLF), launched in 2017, helps small businesses serving as City vendors grow their capacity, hire new employees, and make capital improvements while they deliver on city contracts. The new multi-million city investment into the fund will be leveraged by local lending partners to double the program’s impact, helping an estimated total of 350 M/WBE contractors fulfill $600 million in City contracts by FY 2026. The Fund reflects the city’s commitment to address the “disparity within the disparity” in M/WBE contracting. Since 2017, more than half (53%) of the Fund’s awards have gone to Black and Latino business owners, helping to address challenges these firms face due to historic barriers to financing and credit.

“Access to capital continues to be an obstacle to success for many Black business owners in our city,” Torres-Springer said. “By helping more M/WBEs gain access to financing, we are starting to make real progress in addressing the historic inequalities that have affected so many for too long.”

SBS is also expanding direct outreach to Black-owned businesses to bridge gaps in funding. Just two weeks ago, SBS co-hosted “The Melanin Summit:” a first-of-its-kind event in partnership with SBS’ BE NYC initiative, The Black Institute, and City Council Speaker Adrienne Adams to convene and provide targeted services to M/WBEs that face challenges in City contracting.

“M/WBEs are critical to the growth of our economy and the stability of our communities, which is why the Council has focused on expanding economic opportunities for all,” Adams said. “The Melanin Summit, which connected M/WBEs and other small businesses with Community Development Financial Institutions (CDFIs), is a great example of the Council’s efforts to advance equitable lending and opportunities. Today’s announcement for the expansion of SBS’ Contract Financing Loan Fund program is another necessary step towards supporting increased growth and access to capital for M/WBEs. I look forward to the impact of Black Business Month events on our communities, and the work ahead to continue bridging talent with opportunity for our city’s Black entrepreneurs and M/WBEs.”

For more information on all SBS services, visit to nyc.gov/sbs.

One Comment

Thanks for sharing this amazing post! its organizers, participants, and the outcomes, you can refer to official event announcements, news articles, and coverage from local sources or official government websites.