Oct. 28, 2019 By Christian Murray

The supply of condos and apartments in Long Island City might be increasing but rental and condo prices are remaining firm.

The average net rent paid for a luxury apartment in Long Island City was $3,720 during the third quarter of 2019, up from $3,400 for the same quarter a year ago, according to a report released by Modern Spaces last week.

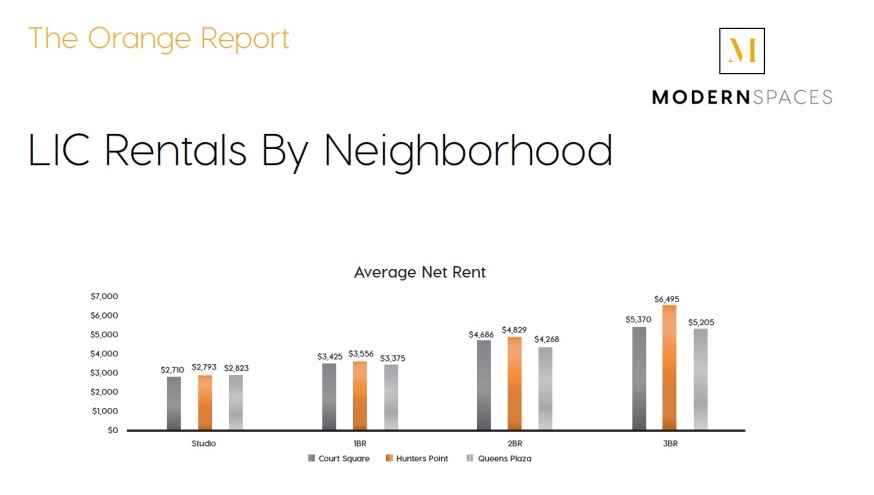

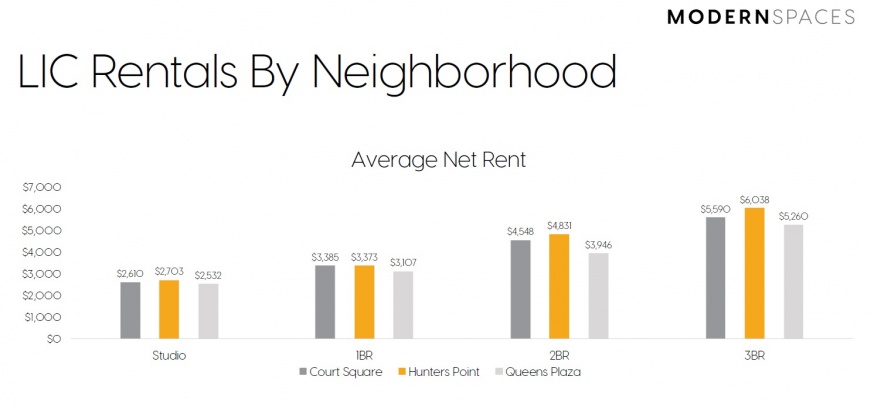

Average net rents for luxury apartments rose in Queens Plaza, Court Square and Hunters Point–and were higher whether it be a studio, 1, 2 or 3- bedroom unit. Most buildings developed in the past 10 years are classified as luxury.

Rental prices during Q3 2019 (Source: Modern Spaces The Orange Report)

Rental Prices during Q3 2018 (Source: Modern Spaces The Orange Report)

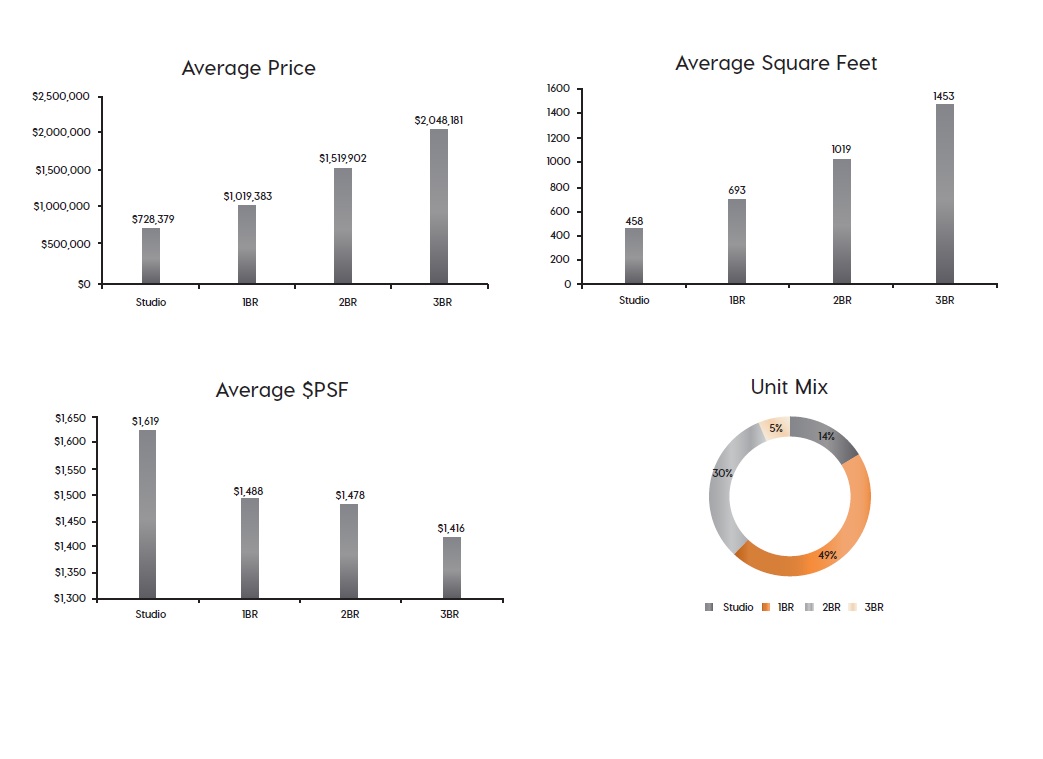

Meanwhile, the demand for Long Island City condos is not waning. The average price paid for a condo that went into contract during the third quarter was $1,193,000, up 8 percent compared to the same quarter a year ago. The average closing price was flat, at $1,004,000, compared to the third quarter in 2018.

“The Long Island City condo market showed no signs of slowing down,” said Eric Benaim, the president and founder of Modern Spaces, adding that the “rental market continues to show signs of growth.”

The average net rent for a studio in Long Island City was $2,798 in the third quarter of 2019, up 6 percent from a year ago. A 1 bedroom fetched $3,494, up 5 percent, and 2 bedroom $4,622, up 2 percent, according to the Modern Spaces report.

Meanwhile, the average price for a studio apartment that went in contract during the third quarter was $728,000; a 1 bedroom $1,019,000 and 2 bedroom $1,519,000.

Click here for report

Average prices that went in contract in Long Island City during Q3 2019 (Source: Modern Spaces The Orange Report)

2 Comments

I am not sure I fully agree with this stance. Eric has been quite vocal in the press about the strength of the market in LIC but thinking that is more posturing and it’s a bit off putting as a client who has had a REALLY tough time selling utilizing Modern Spaces. Granted we are in Northern LIC/Astoria but we had our condo on the market for 7 months+ with literally zero interest (oh and we dropped the price twice). Thinking Eric needs to re-look at his inventory.

I believe that the sales figures are quoted without context. New Development closings always skew the figures. The average sales prices went up is because there were several new developments that we signed 2 years ago (at those prices) began to close. For rentals, the average price may have gon up however that is due to new buildings and the concessions offered. (One to two months free rent etc). It would be interesting to see these figures on existing buildings, not in newly built ones.