Citylights from Gantry Plaza State Park (Photo: WiredNY)

July 10, 2018 By Christian Murray

The residents of Citylights are being slammed with a tax hike and are calling on the city and state for relief.

The residents of the 522-unit building at 4-78 48th Avenue face a 60 percent hike in their monthly maintenance bills over the next five years. The jump is to cover property taxes, since the building’s 20-year tax abatement is being phased out and the building’s assessed value has almost doubled in the past two years.

“My maintenance is going from $2,600 [per month] this year– to $3,900 [per month] in 2022,” said Shelley Cohen, the treasurer of the co-op board. She said that the building has been forced to raise its maintenance 9 percent this year and will be raising it 9 percent each year for the next five years to cover taxes.

“If the city and state don’t do anything people are going to be forced out of their homes,” Cohen said. She said that many co-op owners are unable to cover the abrupt increase and will have to leave.

Residents have held rallies in recent weeks to get the message out about their financial woes. Many turned out when the ribbon was cut on phase II of Hunters Point South Park–to let city and state officials know. They also held a protest in front of the Museum of the the Moving Image when the LIC Summit was held.

“Save Citylights” and “No Longer Affordable,” the protest signs read at both events. Banners have also gone up on 49th Avenue and Center Boulevard to get the word out.

Banner at 49th Avenue and Center Boulevard on July 4(Photo: Shelley Cohen)

The 42-story cooperative is a well-known Hunters Point building, since it was the first high-rise residential development to go up on the waterfront when it opened in 1997. At the time the area was desolate, undeveloped and industrial.

The state, which owns the land that Citylights sits on, wanted to develop the area and worked with developers to get middle-income people to move to the neighborhood.

The state devised a plan where it would attract people through low purchase prices. Studios could be bought for as low as $10,000 and 3 bedrooms for $65,000. The concept was to attract pioneers and middle-income buyers to the area by offering affordable prices, with the trade off being higher maintenance.

The co-op owners were collectively responsible for an $86 million mortgage that covered a large chunk of the development costs. That mortgage kept purchase prices low but inflated maintenance payments in order to service the debt.

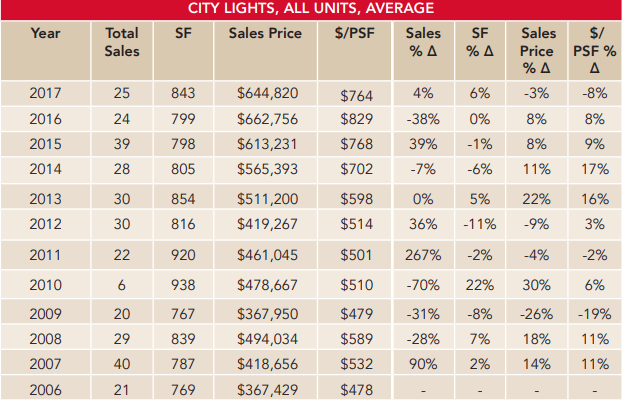

For some the deal paid off, with co-op units fetching sizable sums over the years. The average price paid for a unit was $645,000 in 2017, according to a report released earlier this year by Patrick W. Smith, a broker with Stribling and Long Island City resident.

But property values are starting to drop as the maintenance increases, Cohen said.

In March 2018, a 700-square-foot one bedroom sold for $570,000 and a 1,200-square foot 2 bedroom unit sold for $800,000, according to real estate records.

“Why would someone want to pay $6,700 per month to carry a mortgage and maintenance on a 2-bedroom unit here when they can rent a luxury unit nearby for $4,800,” Cohen said.

Despite the increase in property values over the years, residents argue that the spike in maintenance will force many of them out. Cohen said about 40 percent of the owners are the same middle-income people who bought back in the 1990s and can’t afford the jump.

They argue that they were the people who took a chance on Long Island City and helped make the area what it is today and should not be pushed out.

They claim that they bought their units because the state promised them that the units would be affordable–and now they are not. Cohen said if they were forced to sell their units, many would struggle to find another property since real estate has become so expensive.

Residents who purchased units in later years are also victims, Cohen said, since they had no idea that the city would almost double the building’s assessed value leading to a big hike in taxes.

In 1997 when the co-op was launched the state provided a 20-year property tax abatement to co-op owners as part of the payments in lieu of taxes (PILOT) program. Under the program–similar to the 421a tax exemption program—the owners didn’t have to pay property taxes until June 30, 2018.

The tax is now being phased in at 20 percent per year until 100 percent of the taxes are payable starting July 1, 2023.

The tax bill, however, is dependent on the assessment determined by the City’s Department of Finance. The city assessed the building at $51.7 million in 2016, $96.9 million in 2017 and $101.6 million in 2018.

Starting July 1, 2018, the building is on the hook for $800,000. By the end of phase out it will be $5.8 million, assuming that the assessed value isn’t hiked, Cohen said.

Joanna Rock, who is the president of the board for Citylights, said the co-op is different from condos and other buildings with 421a tax benefits. She said Citylights was marketed as middle income housing by the state and is on state land.

Additionally, she said the state and city are partly to blame for their conundrum. “We are victims of a broken NYC tax system as well as mistakes by the agency that conceived and built Citylights, Empire State Development Corp.”

She said that Citylights has always struggled with maintenance, since the initial $85 million debt placed on the co-op owners was so high that they had almost no chance to pay it back. Furthermore, the building was so poorly constructed, she said, that they have spent more than $10 million in repairs on it with an additional $6 million projected over the next five years to replace elevators and HVAC units.

The annual maintenance to cover the building in 2017 was $10 million—which covers about $4.5 million in debt servicing on the approximately $85 million loan, $470,000 in ground rent to the state and operating costs. The annual maintenance will be $16 million in 2022 when the abatement phases out.

State Sen. Mike Gianaris said that given the tax hike the state needs to renegotiate the phase in period to give the coop owners more time. “It’s not that these people don’t want to pay, it’s just they need more time to be prepared.”

He said the abatement should be extended to 35 years to allow them more time.

“These are the people who have made this community what it is. These are the people who have made it so desirable for others to come here, and the last thing we want to do is drive them out of the neighborhood because it has become too expensive,” Gianaris said last month.

He said that the state is prepared to negotiate the tax rebate period but it needs the city to give its approval. A negotiation can’t take place unless the city gives it the OK.

“New York State stands ready and willing with a workable solution to address the needs of residents of Citylights and we are waiting on the city’s mandated written consent to move forward,” according to the Empire State Development Corp.in an e-mail.

The State cannot legally move forward without city action. The PILOT agreement requires the city’s express “written consent to amend or modify any lease provision relating to or effecting PILOT payments,” according to ESDC.

The city did not say whether it would provide such consent.

“We are aware of the issues surrounding the Citylights building and will continue to work with the property owners and board to the extent we legally can,” according to city spokesperson.

The New York City Tax Commission is reviewing Citylights’ appeal for the property’s 2018-19 tax assessment, and while the appeal is pending, the Department of Finance does not have the authority to make any changes or adjustments to the property’s valuation.”

Councilmember Van Bramer is calling on the city and state for a solution.

“The increased assessment and tax increases for the residents of Citylights puts an extreme burden on many residents who will have to move if the city and state don’t come together with a solution,” Van Bramer said in a statement.

“Many Citylights residents are middle to low income,” he said.

47 Comments

$600K for a freakin airbox in the sky.what were you thinking…..

They will be less then half that in a few years…….with full taxes and maintenance. then it might be somewhat affordable

Some people may not know that the initial construction of this building was financed via a mortgage loan that wasn’t paid off from unit sales but continues to encumber the building. That’s why the apartments were so cheap (i.e., less than most owners’ annual income). It was understood that purchase prices and down payment requirements were very low (averaging around $43 PSF), but that maintenance would be very high because the unit owners were essentially assuming the construction loan. It was a very interesting development play. Typically a developer will bear all costs of construction, and pay off the mortgage loan as units are sold (with each sale requiring a partial pay-down of the loan for a specified “release price”). Because the developer didn’t need to pay off the construction loan, they could afford to sell units for way below market price, presumably less than the cost of construction and related carrying costs.

What I don’t understand is how/why the apartments have appreciated so much, just like the rest of the local market, despite the very different legal and financial structure of this building. You can’t really compare an apt. in this building to a new condo in the area, because the construction cost in a condo is baked into the sale price, but the construction cost in Citylights is baked into the maintenance. These apts. have until recently been much, much cheaper than alternative apts. in the area.

They were marketed from the start as extremely cheap apts., with very, very high maintenance. The unit prices really shouldn’t exceed about one year’s salary for an average buyer. This sub-market is probably overdue for a correction. If I owned an apt. in the building I would definitely look to get out now, and lock in any capital gains, before the correction comes into full swing.

Here is an interesting related article from 1998:

https://www.nytimes.com/1998/03/22/realestate/queens-west-pioneers-are-getting-company.html

^^ one of the more cogent comments I’ve read for any article in a while. Nice!

“Get out now,” is the quote from DPM. What else but a run on the market, the panic and herding of the displaced elderly is this. I repeat, the only people pleased by the unique squeeze on the elderly this sudden and unexpected–indeed punishing and cruel–rise in taxes Citylights’ owners are asked to endure, are real estate people. What is it, 6% for the co-op sale.

The drooling saliva of the wolves, counting the cash, while the stripped elderly are whipped out of their retirement homes. It is a scene from a medieval morality painting–Bosch?

Thanks DPM, for the shove out the door

1. Double taxation. Citylights pays a LAND RENTAL TAX: 10 million so far.

2. City taxes were shoved up in the sort of predatory fashion “developers” deserve after a tax “break” for building with temporary rent relief. Citylights was build on LAND NO ONE WANTED.

Shareholders invested on the reputation enjoyed by luxury rentals–one condo in the 2 million plus range only on NY State land–while paying land rental in lieu of taxes, only to have hyper valuation for our building AS IF we sold at the range of a condo. Good luck.

Real estate professionals can look back at the hype needed way back of newspaper clippings in the days of our polluted and deserted waterfront of 1997-8, and opine all they want. Citylights co-op owners will stand and fight eviction by double and hyped taxation.

A real esta

Taxes go up on one and two family homes every year all over Queens. Most residents are middle class. What makes co-op or condo owners different?

What makes this situation different is the area has become very expensive with high rents and the city taxation department assesses taxes based on what surrounding buildings get for rent. So this building now pays a property tax equivalent to those other high end buildings. Some residents who’ve lived there before the neighborhood morphed into the Mecca it is can’t afford it, some can. More then likely those that can’t will have to sell and move but that’s not what they want. Remember it’s almost a 90% increase, that’s a lot!

My taxes, on a two family home goes up at least a thousand a year. Cost for water goes up every year. Cost to heat home goes up every year. We are also middle class. Salaries, pensions, social security does not go up. We never got tax relief. Expenses just keep going up.

Came here to state the same. No tears for these greedy people from me.

Van Bremmer: “many Citylights residents are middle to low income”

Some are, most aren’t. Some are actually very well off combining two apartments into one and storing multiple high end autos in the parking garage. And there’s the problem, some can’t afford the taxes but many just don’t want to pay them so they use the plight of the few for their own benefit. A better way would be to allow individual exemptions or reductions based on age, income, employment status (retired), and how long you’ve lived there. This would help the retired person that moved there in 1997 while preventing the residents who had the means to buy in over the last 5 or 10 years from enjoying a tax break they don’t need and can afford to pay.

There was no need for the government to step in and force middle class people to move it. Now owner’s and government are caught in a catch 22. The government was trying to force a gentrification but meanwhile gentrification happens naturally… look at Brooklyn! In the end the tax payer will bare the burden for this unintended consequence.

You write: “The government was trying to force a gentrification but meanwhile gentrification happens naturally… look at Brooklyn! ”

Really? Developers in Williamsburg, Park Slope, etc. didn’t receive 421(a) benefits? You sure about that?

Many comments below are infused with envy, and the quality of rage common to all of us facing difficult housing situations. Fact is, people aged in Citylights. After putting my family life savings into buying our apartment, retiring here, my husband and I expected to age in place, using the elevators, as my husband needed to, getting aides for his final illness, and transportation. A good forty percent of resident-owners are aged, the elders who paid in years and taxes to the City.

Only real estate people profit from pressuring old folks to move out, and that is exactly the tactic and the motivation being used. Cynically, commentators below who show envy and hatred of those who “got in on a good deal” play into the divisions and lack of compassion and common sense that envy elicits. We paid taxes and maintenance, and the State collected 10 million over the twenty years for renting the land our building sits on.

All around us, LIC luxury rental buildings on the waterfront PAY NO GROUND RENT– sorry to shout, but Citylights unique double taxation will force elders into the street. Me, also. So the cynical “haters” commenting, if not Russian bots, should perhaps regard all of us as neighbors under the gun, one way or another.

The land is not rented to the luxury rental housing around us. Why not?

The enormous taxation increase on our building is a boon only to the real estate industry. Does Mayor De Blasio not share in the blame if we are made homeless?

A previous poster gave the best solution.

“The problem is some can’t afford the taxes but many just don’t want to pay them so they use the plight of the few for their own benefit. A better way would be to allow individual exemptions or reductions based on age, income, employment status (retired), and how long you’ve lived there.”

We obviously don’t know how many (if any) owners are wealthy people trying to pass the buck. The exemptions mentioned above (including a few more) would be a very fair way to resolve this. I would also include verification of assets and primary residence in order to prevent wealthy owners from taking advantage of this situation. This to me is the only common sense approach for you and every homeowner struggling from gentrification.

Owners knew (or should have known) about the consequences of what will happen once the 421(a) expired. It’s obvious people didn’t do their homework when purchasing into this building. Now they want the public to bail them out? Give me a damn break!

I have to agree with you here Drumpf. When the current residents (and no doubt absentee owners) of these apartments purchased them they knew that their abatements would start expiring around now.

I don’t see an analysis of how much they will be paying per square foot in taxes versus how much people in luxury condos and co-ops in other desirable parts of NYC but if it is similar to other buildings/neighborhoods, it is about time that City Lights unit owners started paying their fair share.

This is the unintended consequence when you have the dirty hand of government trying to “make things better”. This is a back ended temporary rent stabilization situation that people just didn’t prepare for. Now the value of the gov’t owned property is nearly worthless and occupants are now on the hook. The solution was to just sell at market price for people who can afford it. Plain and simple. This dream that government is like a monarch and can make the world a better place obviously doesn’t work. History says so and people are insane to think otherwise. What will happen is that MORE government will be involved and muck it up even worse. The tax payer will pay for it. THIS is why taxation is thievery and its cohorts are thieves in suits.

Do you know what LIC was like in 1997? Nobody would have moved there or built a high rise in that area without the “government hand.”

Now a lot of developers are getting rich as a result of that initial push (not to mention all the great new parkland we’ve got down there).

But development never would have happened without a kickstart.

LIC was better in 1997 than the overcrowded mess it is now. It is a mini Manhattan and that stinks. It was a nice small community in 1997. It is a faceless,place of greed and snobbery now with Manhattan pricing. It was so much cheaper and still would be without all the over development without proper planning that is currently going on.

Yeah unfortunately these greedy developers like the president you voted for keep building, and now it’s much much easier for them to build with a greedy developer as president giving them tax breaks.

His luxury condo developments in Manhattan (which gave jobs to massive amounts of illegal immigrants) drove up costs there which is why people had to flee to nearby neighborhoods like LIC and increase rent prices here.

And you sing his praises! Hilarious. Too bad all the money you pay in rent leaves you too broke to grow a backbone.

You talk as if this rapid gentrification happened under Trump. This started way before him & now Deblasio is killing us even more with his expanded rezoning coupled with the fake “affordable” housing. You need to wake up and realize that all politicians from both parties get big contributions from major developers in return for favors. They are all the same sh*t waving different political flags.

Up until the late 90’s LIC was filled with stripjoints, topless hookers, pimps & crackheads. The city was begging for developers to come in and build. I’m surprised it even took this long considering that LIC is only 5 minutes away from Manhattan by train, ferry, Queensboro bridge & the Queens midtown tunnel. It was only a matter of time!

Up until the late 90’s the majority of LIC was filled with stripjoints, topless hookers, pimps & crackheads. The city was begging for developers to come in and build. I’m surprised it even took this long considering that LIC is only 5 minutes away from Manhattan by multiple trains, ferry, Queensboro bridge & the Queens midtown tunnel. It was only a matter of time!

I was in LIC long before the late 90’s and it wasn’t as bad as people make it seem. Maybe the area near the water was a bit desolate, but Court Square definitely was NOT.

Life-long Astoria/LIC resident and you, Sir, are 1000% correct.

and don’t forget all the queens counsel people that got plenty of money in their pockets also – so there you go.

The FAKE MRLIC wrote the July 11, 2018 comment on Greedy Developers.

If as Van Bramer comments, “many of the City Lights residents are middle to low-income,” why not apply for low to middle-income housing through the lottery!!!

First of all if the city is held back on taxes as an incentive should only be assess the building for what it was worth when these folks bought in and maybe add a RESONABLE exit tax only when they sell. Otherwise the smell of money is suffocating!

What a SCAM, if they were going to do this right the original owners would be taxed on the original price the paid and subsequent owners on the price they paid. like Cali’s prop 13….. the taxes would be on the new market value for the new owners.

421 A is the culprit and the city continues to use it as a developer incentive. It’s happening all the time, this is not a surprise, you can’t expect to have not understood this tax exemption if you bought here. We are going to have a ton more buildings come due in the future. This is city and state shenanigans combined with rampant development deals in the name of MIH. Tip of the iceberg. And because of the exemptions we haven’t had taxes, for schools, infrastructure etc. We need comprehensive planning NOW. A moratorium on building should take place until sustainable growth can be planned.

Amen, 421 A has destroyed neighborhoods and caused congestion and small business blights where it’s been abused.

The Developers and Realtors have engaged in a “Take the money and run” Con game from the get go.

HAHAHA WHAT LOSERS they knew it was coming and didn’t prepare for it now they want You and YOU and YOU and YOU, to bail them out for bidding these airboxes in the sky to ridiculous price levels

There is a blog that for the last 12 year has been documenting all the idiot home buyers and every scam possible to jack prices up to un-affordable levels. you will get addicted to this blog as i have http://thehousingbubbleblog.com/index.html

Now its time to pay the piper there should have NEVER bee any 421 tax abatement on LUXURY APARTMENTS only on Low cost basic housing

Its was a SCAM to increase the price $100,000+ because the “How Much a month” crowd was the target buyer.

This building is on State-owned land. If the State is concerned about providing affordable housing, why not just give the land to the co-op, with certain lease conditions and restrictions? Not give it to the City, but the co-op owners. I don’t know the ramifications of having a building such as this on City-owned land. Would it then have to become a NYCHA property? And if it did, would that be good or bad?

Isn’t a high percentage of the monthly mortgage tax deductible due to the unusual circumstances of this bldg?

I love how the sidewalk planters and pots around the Citylights Building are always immaculately maintained and replanted at least a few times during the growing season. Keep it up please, though I’m sure it costs a pretty penny you may no longer have.

Thankfully the greedy real estate developer I help elect as president has shown he loves giving tax breaks to the super wealthy. I hope he can step in and help these greedy developers, I love developers and luxury condos!

Just pointing out that tax breaks are actually passed on to the owners of the units. Once the building is sold, the tax breaks don’t affect the developers anymore. So, the people in City Lights have been paying abated taxes since the building was built until 2018. That’s why the taxes are going up so quickly.

Still crazy prices though. I can understand why they are upset.

My rent for a brand new 2 BR 2 Bath on a high floor is $3,900. That is about $47,000 a year for maintenance. In 10 years, that is $470,000. Just for maintenance.

Wha Wha There goes affordable housing NOT

I was wondering why so many apartments were on sale! It seems many are in fact cashing out. Can’t blame them with this report. Who would buy into this building at this stage. Maintenance charges should never be that high. Poor planning all around.

That is insane $3,900 per month maintenance. Not even upper east side luxury buildings paying that much maintenance….. Selling = $$ and if you purchased on the cheap then you can get out of this mess and walk away with some money in your pockets or wait it out until an offer comes through for the entire bulding and the land underneath from a developer….

Why not just lower the maintenance?

Every other COOP in the city has to deal with paying taxes. If you can’t afford it just cash out, especially if the unit you purchased for 50k is now worth over 800k.

Who cares about a handful of well-off residents? So what if their apartment becomes unaffordable? Join the club…

Very little synpathy towards these people.

Even dog know these residents not wealthy. Dog know when this building went up, area considered undesirable. Dog know this building was also affordable to middle class. Very hard to sell these units now with such high overhead. Also many residents don’t want to sell, they like the area, and want to be able to stay in what they were sold on as “affordable housing”.

Anyways, dog know when your 421-a is nearing end, your home will depreciate. You have to be a dummy to own in any of these new constructions.

Thank you. I still can’t get over how 644,000 USD for 870 square feet is considered ‘affordable housing”?

When most condos are going for $1200-1500 a Sq foot, $763 a Sq foot is a steal.

State Sen. Mike Gianaris and Mr. JVB got paid well in their pockets for this building – fact and now they are complaining.